Trump pushes for emergency power auction to support AI boom

Published in Business News

The Trump administration and more than a dozen states are pushing for big tech companies to effectively fund construction of new power plants as a way to prevent data centers from driving up residential utility bills.

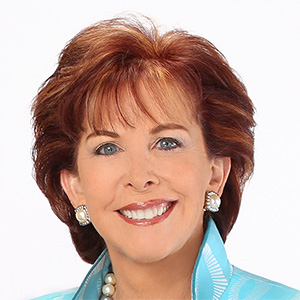

U.S. Energy Secretary Chris Wright and Interior Secretary Doug Burgum joined 13 governors in outlining a plan urging the nation’s biggest grid operator, PJM Interconnection LLC, to hold an emergency auction so tech companies can bid for long-term electricity contracts.

Although their framework isn’t binding on PJM, the governors represent every state served by the grid operator, including one that’s threatened to pull out if costs aren’t controlled.

The unprecedented initiative has two goals: First, it aims to accelerate the construction of new power plants — especially those capable of providing round-the-clock electricity — to supply data centers crucial to the artificial intelligence boom. Second, it seeks to address growing tensions over who will bear the burden of rising electricity demand as consumers confront higher utility bills.

It’s “essentially guidance” to help PJM “come up with a policy that’s going to enable our goals of affordability for consumers, but also the power we need to keep our economy going — in particular to power the data centers we need to drive the AI arms race,” Burgum said.

The emergency auction would allow tech companies to bid on 15-year contracts for new electricity generation capacity, helping to secure supplies and curb price volatility. It would be run by PJM Interconnection LLC, which operates the grid spanning from Virginia to Illinois.

The auction would award contracts supporting the construction of some $15 billion worth of new power plants. That could be enough to add 7.5 gigawatts of generating capacity to PJM’s grid, according to a report from Jefferies. A gigawatt is roughly the output of one large nuclear reactor.

The Energy Department said in a fact sheet the plan would mean data centers will “pay for the new generation built on their behalf – whether they show up and use the power or not.”

The coalition’s blueprint also presses PJM to extend an existing price cap, limiting the amount that existing power plants charge — a key ask from Pennsylvania’s Democratic Governor Josh Shapiro.

PJM serves more than 67 million people from the Mid-Atlantic to the Midwest. The grid operator is already home to the world’s biggest concentration of data centers, in northern Virginia, and it has said it expects peak demand across its system to jump 17% by 2030 from this year’s high.

Governors, including Shapiro, Maryland’s Wes Moore and Virginia’s Glenn Youngkin, took turns at a Friday event unveiling the initiative in lambasting PJM, blaming the grid operator — whose representatives weren’t invited to the event — for moving too timidly in getting new electric generation online.

“We cannot build a 21st century economy on an energy market that blocks new supply,” Moore said. “We need for PJM to take action. We need for PJM to take this seriously.”

PJM spokesman Jeffrey Shields said the grid operator was reviewing the principles that were announced and “will work with our stakeholders to assess how the White House directive aligns with the board’s decision.”

Late Friday, PJM released a 14-page plan to bring online data centers faster, including triggering its backstop reliability mechanism. However, the grid operator said it would direct its staff to come up with a plan — one that could very well end up being similar to what the White House proposed.

Trump administration officials and governors expressed confidence PJM would take their suggestions. “I would be surprised if we don’t see something along these lines,” said Energy Secretary Wright.

Shapiro, who’s used the threat of a Pennsylvania retreat from PJM as leverage to push price caps previously, said it would be in the operator’s “best interest” to adopt the changes.

“I’ve been very clear if PJM doesn’t clean up its act, Pennsylvania is the second largest energy exporter in the country — we’ll be forced to go on its own,” Shapiro said.

Many power companies can’t shoulder the cost of building new generation without long-term commitments from buyers to purchase electricity. Meanwhile, PJM holds regular power auctions for electricity supplies in 12-month periods.

The Trump administration’s plan for a 15-year auction would secure revenue for more than a decade in a market notorious for price volatility and generator bankruptcies. In turn, tech companies would be able to lock in the electricity they need — and simultaneously, developers would likely have more confidence in the long-term outlook to take on the big investment of building more plants.

“Our messaging is just to try to push PJM — this 13-state region that manages the electricity grid — to say we know the answer,” Wright said. “The answer is we need to be able to build new generation to accommodate new jobs and new growth.”

Even with an emergency auction held by the end of September, it would be challenging to quickly ease surging consumer utility bills. There would still be a lengthy process before new power plants are built and more supplies enter the market.

Cost-of-living concerns are already weighing heavily on Republicans’ bid to maintain control of the House and Senate in this November’s congressional elections. While Trump has stressed the plummeting cost of oil and gasoline since he took office last January, electricity prices have climbed due to rising demand — and there’s a building backlash against data centers that are fueling the surge.

Meanwhile, a long-term auction would likely mean that Trump is handing tech companies what they’ve been desperately seeking: a massive supply of new electricity they can depend on to energize hundreds of billions of dollars in mega-data centers now under construction. Amazon.com Inc., Microsoft Corp., Alphabet Inc., Meta Platforms Inc. and OpenAI have already collectively invested in the development of several gigawatts of new power — with a single gigawatt typically enough to power roughly 750,000 homes.

One of the biggest beneficiaries in reaction to the move was the maker of natural gas turbines GE Vernova Inc., which climbed 6.1% on Friday. Jefferies said it sees it as a winner from the auction after initial details on the agreement were first reported by Bloomberg News on Thursday.

Shares of the largest independent power producers slid. Vistra Corp. declined 7.5%, Talen Energy Corp. slipped 11% and Constellation Energy Corp. dropped 9.8%.

The emergency auction plan comes one month after three Democratic senators opened a probe into how data centers drive up monthly customer bills, citing a Bloomberg News investigation that found electricity now costs as much as 267% more in areas near significant data center activity.

“We have a simple problem of a market disconnect: We can put up a data center in 18 months and it takes five years to build a power plant,” said Teri Viswanath, lead economist for power, energy and water at CoBank ACB. “This is a very difficult challenge with no easy solutions.”

©2026 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments